Candlesticks

Originated in Japan over 100 years before the West developed the bar and point-and-figure charts. In the 1700s, a Japanese man Homma discovered that, while there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of traders.

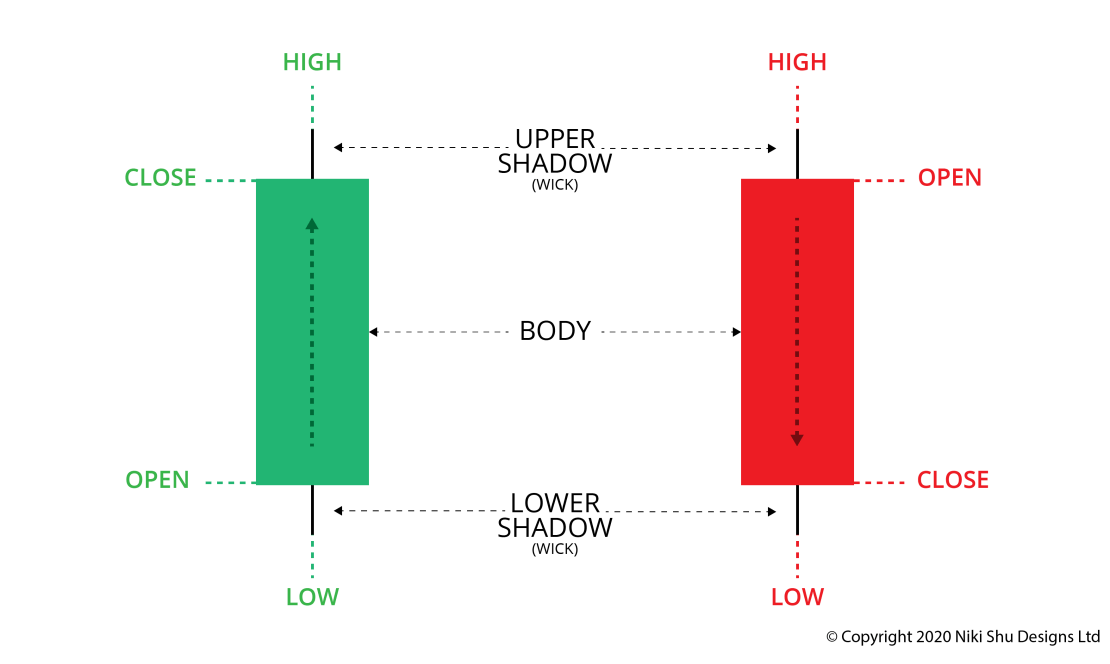

Candlesticks show that emotion by visually representing the size of price moves with different colors. Traders use the candlesticks to make trading decisions based on regularly occurring patterns that help forecast the short-term direction of the price.